Friday, November 03, 2006: Impressed by

the ability of the Indian companies to make smart acquisitions as

well as turn around loss-making private and public companies abroad,

foreign institutions and overseas banks have increased their lending

to

Indian companies for investment abroad.

Interestingly, the $5 billion they have lent in the first four months

of this fiscal (till August) to Indian companies is double of what

they have lend during the same period in the last fiscal, secretary

(industrial policy and promotion), commerce and industry ministry,

Ajay Dua, told FE.

He added that the total lending of foreign institutions to Indian

companies has gone up to $17 billion last fiscal, up from from $13

billion in the fiscal prior to last. Overseas banks have started

believing in the ability of the Indian companies to make operations

profitable, Dua said.

In the case of leveraged buy-outs LBO), the foreign financial institutions

are not only looking at the assets being purchased by the Indian

companies, but also the profitability and the productivity of those

companies. The FDI outflows from India in 2005-06 was $4.5 billion

against an inflow of $5.6 billion during the same period. According

to a recent CII-Crisil study, in 2005-06(till September), the average

amount of investment of India companies abroad was roughly $ 61

million with the largest investment being $777 million and the smallest

being $1.32 million.

Dua said this trend of FDI outflows increasing will only continue

as Indian companies are showing an increasing appetite for global

acquisitions.

He said, “Buying foreign companies gives them access to overseas

markets. The access, coupled with the credibility the Indian companies

gain through such a move, helps them to sell their brands abroad

without undertaking a separate exercise for brand building.”

|

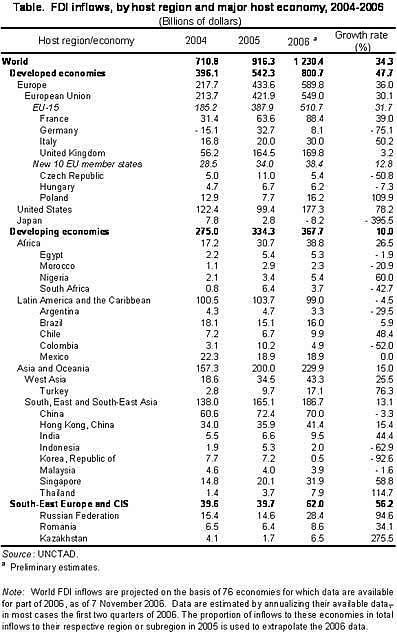

| Source: UNCTAD |

Indian companies are also turning around loss-making private

and public companies abroad by shifting a part of the operations

to India and also by cost-cutting management initiatives, he said.

Said Jayesh Desai, national director (transaction advisory services),

Ernst and Young, “The trend started with liberalisation

of regulations, from a case by case approval to the government

presently permitting automatic approval for Indian companies to

invest abroad of up to 200% of its net worth.

Besides, Indian companies are quickly learning the game as they

have started using debt financing. They will have to now start

learning to use equity for these transactions. This will help

them scale up from $10-20 million deals to deals above $1 billion.”

Vivek Bharati, advisor (National Policy, Programme & Projects),

Ficci, said, “FDI outflow will increase especially in knowledge

driven and the engineering sectors. The companies, after firmly

establishing themselves in the domestic market, take

over foreign companies or have joint ventures with them to acquire

competencies that they don’t have and also for getting major

market shares.”

Source: http://www.financialexpress.com/fe_full_story.php?content_id=145305